Reliance-Future Group Deal Cleared, Sensex Scores 50,000 !

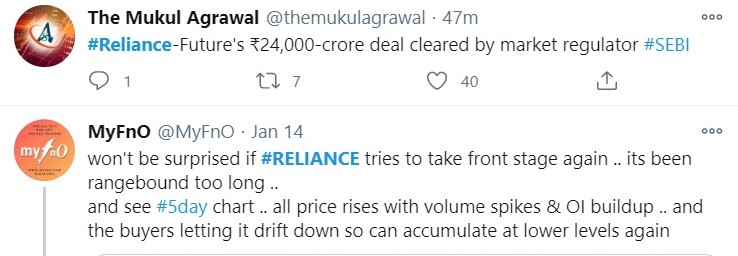

In August last year, Kishore Biyani led Future Group had entered into a Rs 24,713 crore agreement to sell its retail, wholesale, logistics and warehouse businesses to Reliance Retail Retail Ventures. The Securities and Exchange Board (SEBI) gave its green signal for the deal which led to the rise of share price of Reliance Industries by nearly 2 percent. SEBI stated on the issue: "The company shall ensure that the shares of the transferee entity issued in lieu of the locked-in shares of the transferor entities are subjected to lock-in for the remaining period post scheme,". The news was quick to gather momentum and garnered impressions on the social media platforms:

It would not be surprising if Reliance takes the front seat again:

For several months now, Reliance Industries has been trading at a slow and gradual pace, this breakthrough not just comes as a surprise but also installs a sense of confidence in the stockholders.

Rohan Patil, a technical analyst at Bonanaza Portfolio, when approached for insights, commented: "For the last couple of months, Reliance Industries had been trading within a narrow consolidation range on the daily timeframe. On January 18, the stock finally witnessed a consolidation breakout, trading above its trendline support. In this recent price spurt, the stock has given a breakout about its 21 and 50-day moving averages on a daily timeframe, which is extremely positive for the counter,".

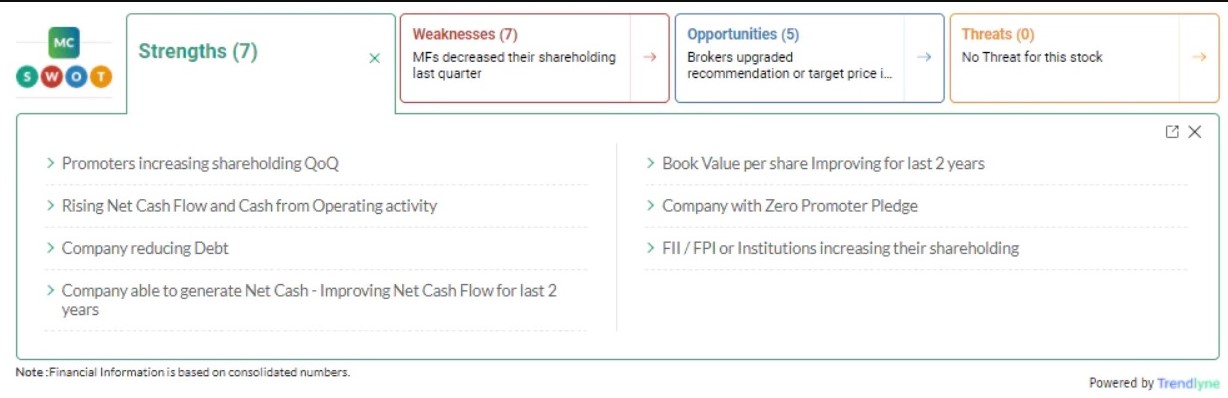

As per a report published in Moneycontrol, it happens to be a good opportunity to invest in this stock since no substantial threats are projected as of now:

Reliance has gone up from 1975 to 2111 inspite of the not-so-good financial year for trade, economy and business.

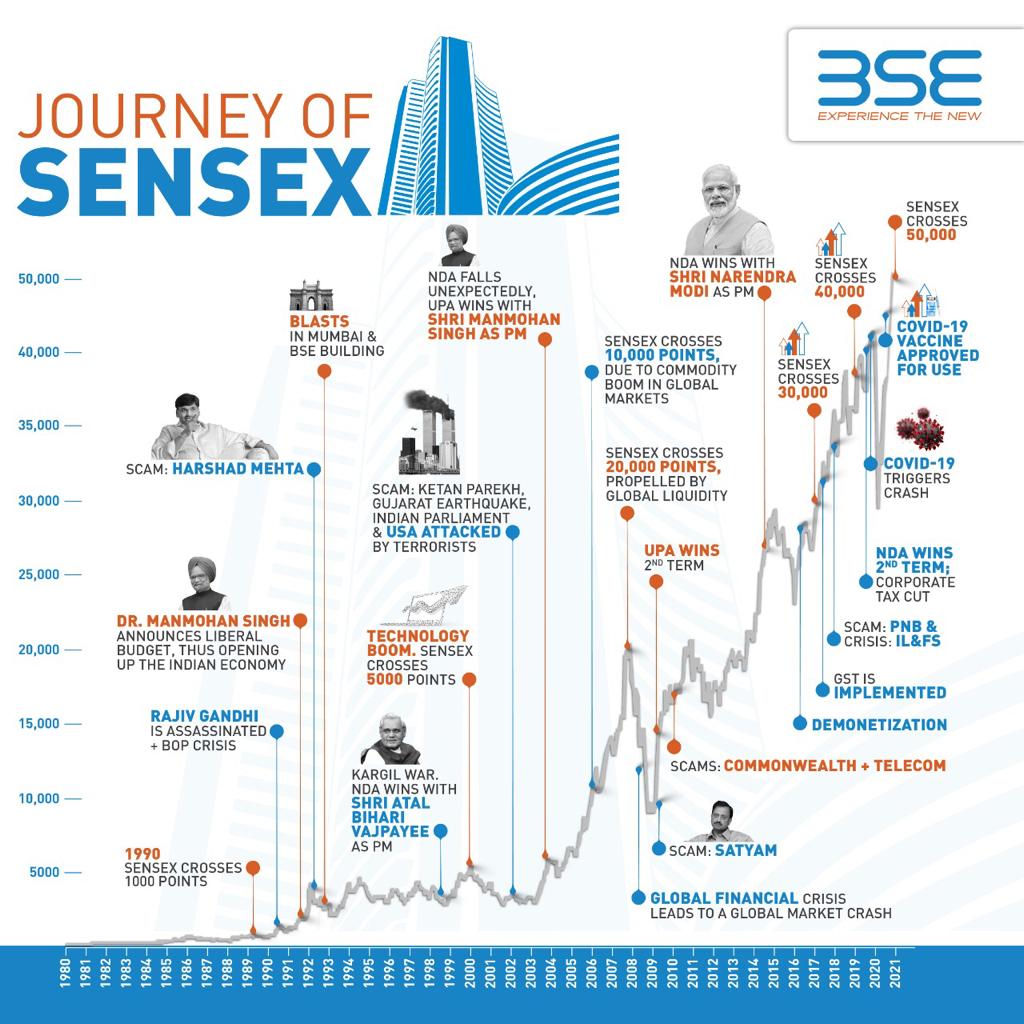

Sensex Reaches 50,000 Points:

The gains were not just accumulated by Reliance but the Sensex itself hit the 50,000 mark for the first time on 21st January 2020. After touching a lifetime high of 50,126.73, the BSE index was trading 300.09 points or 0.60 percent higher at 50,092.21 in opening deals. Bajaj Finance, Reliance Industries and Axis Bank were among the top gainers while TCS and HDFC lagged behind.

The United States equities finished at record highs on after Joe Biden was sworn in as the President of the United States and he vowed to take all necessary measures to bring back the US economy on track. The hope for an economic stimulus paved way to create a sense of confidence.

Social media platforms bursted out with excitement with memes being created:

Another one to loose out were the metal stocks comprising of Hindalco and JSW steel. Adani Ports also traded with lower margins.

Similar conditions were observed in other asian economies. Hong Kong's Seng breached its 30,000 level while Japan's Nikkei was up by 0.72 percent.

The Dow Jones Industrial Average rose by 0.83 per cent, the S&P 500 gained by 1.39 per cent and the Nasdaq Composite added 1.97 per cent.

Sensex has hit the 5000 mark in the year 1999 and from there it took eight years to reach the 20,000 mark and 12 years after that to reach 40,000, but it took less than two years to gain another 10,000 points.

Similarly, the broader NSE Nifty also surged, by 85.40 points or 0.58 per cent to trade at 14,730.10. It too scaled its highest level of 14,738.30 in early trade.

Foreign portfolio investors (FPIs) were net buyers in the capital market as they purchased shares worth Rs 2,289.05 crore on Wednesday, as per exchange data.

Binod Modi, Senior Research Analyst at Reliance Securities commented: “We believe underlying strength of the market remains intact given continued recovery in key economic data and expectations of sustained recovery in corporate earnings. Further, ongoing vaccination drive and likely opening-up of economy at full scale augur well for the economy and equities."

Meanwhile, the global oil benchmark Brent crude was trading 0.30 per cent higher at USD 55.91 per barrel.

To keep yourselves updated with the latest trends, don't forget to visit Checkbrand.

CATEGORIES

- Digital Marketing

- Marketing

- Entertainment

- Medical

- Science and Technology

- Politics

- Sports

- Environment

- Campaign

- Interview

- Viral

- What's Trending

- Trending News

- Viral Videos

- Youtube Trends

- Social Media Ranking

- Twitter Trends

- Google Trends

- Top Politicians

- Top Cricketers

- Top Influencers

- Best Campaigns

- Google News

- News

-

Oct 11, 2020

Oct 11, 2020SEO Content Writing Vs. SEO Copywriting:...

-

Dec 15, 2020

Dec 15, 2020#Karnatakaiphoneplantagitation: Workers...

-

Dec 15, 2020

Dec 15, 2020#OLA Invests ₹2400 Crores For Our Futur...

-

Dec 15, 2020

Dec 15, 2020#Snapchat Launches Astrology Profile

-

Dec 15, 2020

Dec 15, 2020Know Why #BOYCOTTJIOSIM Is Trending On S...

-

May 17, 2023

May 17, 2023Zara Hatke Zara Bachke Trailer Review(Ra...

-

Aug 01, 2023

Aug 01, 2023India's Chandrayaan-3 On Track For Lunar...

-

Jan 29, 2021

Jan 29, 2021Gita Gopinath: The Government Must Ramp...

-

Dec 16, 2020

Dec 16, 2020#Skillhaitohfuturehai: Mahindra's Flagsh...

-

Jan 16, 2021

Jan 16, 2021Indian Runs World’s Largest Vaccination...

HIGHLIGHTS

- Realme Pad Specifications Teased, Will C...

- MARKETS: Sensex Down 300 Pts, At Days Lo...

- Afghanistan Crisis Live Updates: NIA Chi...

- Women Will Be Admitted To NDA, "Historic...

- Taliban's New Education Minister Says Ph...

- India's T20 World Cup Selection Question...

- New JioFiber Quarterly Broadband Plans I...

- Explained: How Your Cat Got Its Stripes...

- Who Is Aesha Mukherji? All You Need To K...

- Long Live Test Cricket While We've Virat...