Closing Bell: Sensex ends on a calm note

The last trading day of the fateful 2020 turned out to be good for the Nifty which closed with nearly 15 percent gains. Social media platforms have been bustling with the news already:

The sensex has closed at 47,751.33 points while Nifty has settled at 13,981.75. Let us have a quick recap of the markets in 2020 according to credible media sources.

The year in general may have been not so fruitful but it has definately brought respite in certain forms for the financial market:

⦁ Nifty gained 5th year in a row, rises over 10% in each of last 2 years

⦁ Nifty Bank snaps 4-year gaining streak, all stocks decline except Kotak Bank and HDFC Bank

⦁ Nifty Midcap snaps 2-year losing streak, outperforms Nifty

⦁ Nifty Small snaps 2-year losing streak, outperforms Nifty

⦁ Nifty Pharma snaps 4-year losing steak

⦁ Nifty IT gains for 4th year in a row and posts best year since 2013

⦁ Nifty PSU declined third year in a row by losing over 30% in 2020

⦁ Indi VIX gained over 75% to post best year in history

⦁ Rupee ends at highest closing level since Sept 2

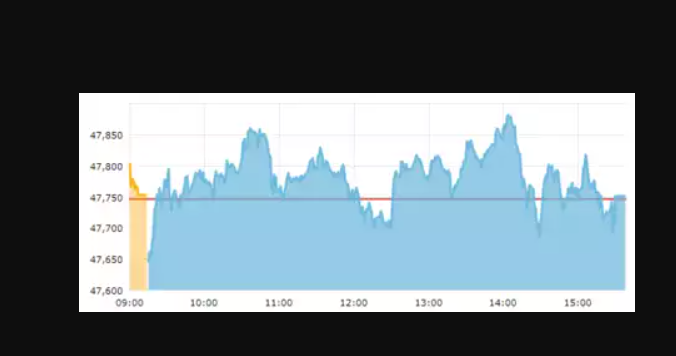

The graphical representation of the sensex for 31st December, 2020 is provided below:

Some of the top gainers are listed below:

1. VIP Industries

2. Crompton Grieves

3. Indiabulls

4. IRCTC

5. Abbott India

Anindya Banerjee, DVP, Currency Derivatives & Interest Rate Derivatives of Kotak Securities stated:

"2020 has been a year where RBI played an extremely important role of keeping volatility in check. They sold aggressively when USD rose in value during Covid panic of March-April. Then they bought close 100 billion dollars, to prevent Rupee from appreciating, when inflows gushed to Indian capital markets. During 2021, If the global trend of USD remains downward, Then USD INR can decline towards 70.00 levels"

Ajit Mishra, VP of Religare Broking said:

"In a choppy trading session, the Indian markets traded in a tight range amid stable global cues. Investors would await the auto sales numbers and PMI data as it would help in gauging the economic recovery. Further, global cues are likely to dictate the trend for the markets in the near-term. We reiterate our cautious stance on the markets"

The COVID-19 pandemic brought the world to a complete standstill and had adverse effects on the market, hopefully the upcoming 2021 will bring some respite and bring gains for the investors. To know what has been trending on the digital media platforms, don't forget to visit checkbrand.online, a one stop solution for all your digital queries.

CATEGORIES

- Digital Marketing

- Marketing

- Entertainment

- Medical

- Science and Technology

- Politics

- Sports

- Environment

- Campaign

- Interview

- Viral

- What's Trending

- Trending News

- Viral Videos

- Youtube Trends

- Social Media Ranking

- Twitter Trends

- Google Trends

- Top Politicians

- Top Cricketers

- Top Influencers

- Best Campaigns

- Google News

- News

-

Oct 11, 2020

Oct 11, 2020SEO Content Writing Vs. SEO Copywriting:...

-

Dec 15, 2020

Dec 15, 2020#Karnatakaiphoneplantagitation: Workers...

-

Dec 15, 2020

Dec 15, 2020#OLA Invests ₹2400 Crores For Our Futur...

-

Dec 15, 2020

Dec 15, 2020#Snapchat Launches Astrology Profile

-

Dec 15, 2020

Dec 15, 2020Know Why #BOYCOTTJIOSIM Is Trending On S...

-

Aug 01, 2023

Aug 01, 2023India's Chandrayaan-3 On Track For Lunar...

-

May 17, 2023

May 17, 2023Zara Hatke Zara Bachke Trailer Review(Ra...

-

Aug 04, 2022

Aug 04, 2022'Har Ghar Tiranga' Campaign Created Stor...

-

Dec 16, 2020

Dec 16, 2020#Skillhaitohfuturehai: Mahindra's Flagsh...

-

Dec 15, 2020

Dec 15, 2020#OLA Invests ₹2400 Crores For Our Futur...

HIGHLIGHTS

- Realme Pad Specifications Teased, Will C...

- MARKETS: Sensex Down 300 Pts, At Days Lo...

- Afghanistan Crisis Live Updates: NIA Chi...

- Women Will Be Admitted To NDA, "Historic...

- Taliban's New Education Minister Says Ph...

- India's T20 World Cup Selection Question...

- New JioFiber Quarterly Broadband Plans I...

- Explained: How Your Cat Got Its Stripes...

- Who Is Aesha Mukherji? All You Need To K...

- Long Live Test Cricket While We've Virat...