IRFC opens IPO for just three days: Hurry before its late !

In one of the first in this year, alongside Indigo paints, the Indian Railways Finance Corporation opened its initial public offering for the public on January 18th. The same would be closed by January 20th. According to the reports, the book running lead managers are DAM Capital Advisors, HSBC Securities and Capital Markets (India), ICICI Securities and SBI Capital Markets. The aim to raise approximately Rs 4,633.4 crore. The announcement instantly dominated the social media trends:

The Indian Railways currently holds one hundred percent stake and aims to offer a sale for around 594 million shares worth Rs 1,480 crore. Post sale, the stake of the centre is projected to come down to approximately 86.4 per cent. The offer is 50 per cent reserved for Qualified Institutional Buyers; 15 per cent for Non-Institutional Investors; and 35 per cent for Retail Individual Investors. It must also be taken into consideration that 5 million equity shares have been reserved for the employees of the Indian Railways. The price for per share is fixed at Rs 25-26.

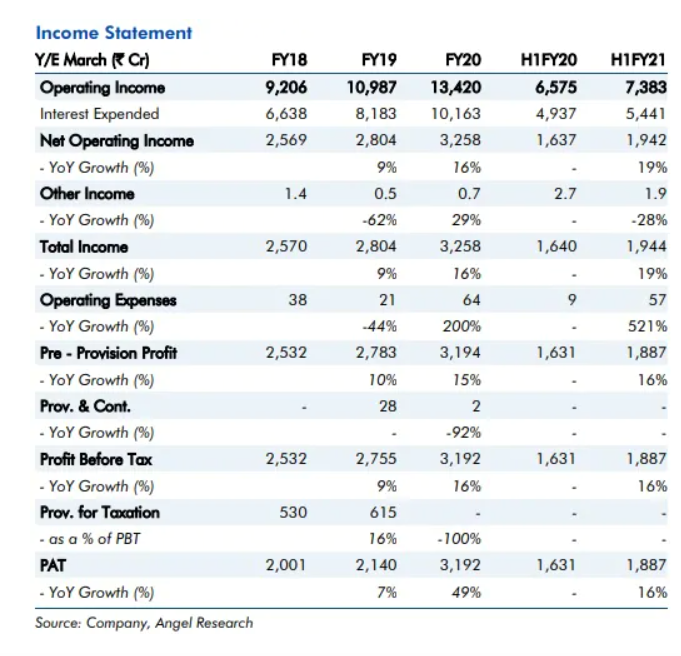

Indian Railways also seem to have a strong registered growth in income:

Should we subscribe ?

Senior research analysts have commented that the model is one of its kind. However, it is an undervalued offering and later changes in policy framing can affect overall profits. “The strong fundamental aspects are making it a good bet for not just listing gains but also for long-term investment, said Likhita Chepa, Senior Research Analyst at CapitalVia Global Research.

Furthermore, the Railways will be investing in progressive schemes in the upcoming years. Some of which are:

⦁ ‘Adarsh’ Station Scheme

⦁ 188 New Line Projects with 55 Gauge Conversions

⦁ 255 Track Doubling Projects

⦁ Inclusion of Automatic Train Protection (ATP) system

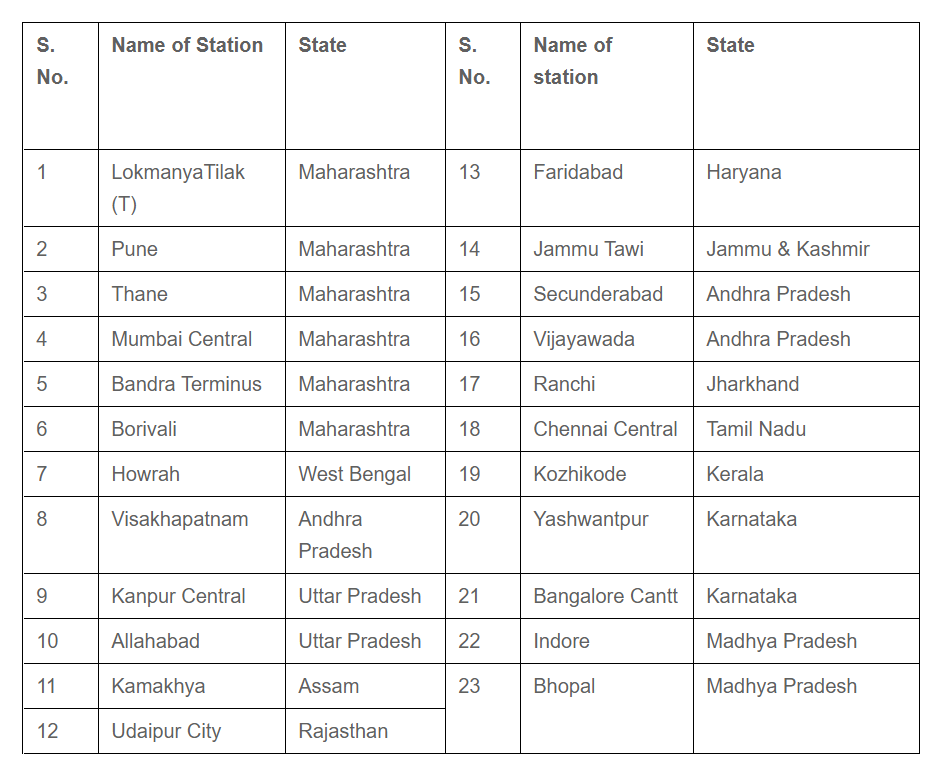

⦁ Redevelopment of stations, In the first phase alone, 23 stations have been identified:

Furthermore, the issue price seems to be very attractive to woo the customers. Abhay Doshi, Founder, UnlistedArena.com told the media that: “Although the size of the issue is quite big and dates of IRFC IPO will clash with Indigo Paint IPO, we may not see huge oversubscription and stellar listing gains like recent IPOs hence, investors with a medium to long term view may find it suitable.”

Brokerage companies like LKP securities have also given a "good to go" signal for the investors to proceed with investments in the issue.

There are several reasons as to why one can afford to subscribe:

⦁ IRFC holds a healthy financial position

⦁ IRFC boasts of a strong credit rating. It has received the highest credit ratings from CRISIL – 'CRISIL AAA' and 'CRISIL A1+'; ICRA – 'ICRA AAA' and 'ICRA A1+'; and CARE – 'CARE AAA' and 'CARE A1+'

⦁ There seems to be a low business risk

⦁ The growth prospect is strong for IRCTC since it plans to take several developmental projects in the upcoming years which includes electrification and doubling of tracks

A note by Sharekhan, India's leading broking house read: "There are no comparable peer companies which operate in a business space similar to that of IRFC. However, relative to other PSU NBFCs, IRFC stands apart with nil NPAs but lower (albeit stable) margins. On a diluted basis at the upper price band, IRFC is valued at 1x FY20 BVPS. However, being the dedicated market borrowing arm for the Indian Railways, IRFC enjoys the highest possible credit ratings for an Indian issuer both for domestic and international borrowings."

There seems to be a lot of optimism in this regard and on the future of the IRFC, therefore the final verdict would be to go ahead and make an investment. This verdict is substantiated by not just facts but opinions which has been propagated by leading specialists in the field.

To keep yourselves updated with the latest trends all around the globe and the ones on social media platforms, don't forget to visit Checkbrand.

CATEGORIES

- Digital Marketing

- Marketing

- Entertainment

- Medical

- Science and Technology

- Politics

- Sports

- Environment

- Campaign

- Interview

- Viral

- What's Trending

- Trending News

- Viral Videos

- Youtube Trends

- Social Media Ranking

- Twitter Trends

- Google Trends

- Top Politicians

- Top Cricketers

- Top Influencers

- Best Campaigns

- Google News

- News

-

Oct 11, 2020

Oct 11, 2020SEO Content Writing Vs. SEO Copywriting:...

-

Dec 15, 2020

Dec 15, 2020#Karnatakaiphoneplantagitation: Workers...

-

Dec 15, 2020

Dec 15, 2020#OLA Invests ₹2400 Crores For Our Futur...

-

Dec 15, 2020

Dec 15, 2020#Snapchat Launches Astrology Profile

-

Dec 15, 2020

Dec 15, 2020Know Why #BOYCOTTJIOSIM Is Trending On S...

-

Aug 01, 2023

Aug 01, 2023India's Chandrayaan-3 On Track For Lunar...

-

May 17, 2023

May 17, 2023Zara Hatke Zara Bachke Trailer Review(Ra...

-

Aug 04, 2022

Aug 04, 2022'Har Ghar Tiranga' Campaign Created Stor...

-

Dec 16, 2020

Dec 16, 2020#Skillhaitohfuturehai: Mahindra's Flagsh...

-

Dec 15, 2020

Dec 15, 2020#OLA Invests ₹2400 Crores For Our Futur...

HIGHLIGHTS

- Realme Pad Specifications Teased, Will C...

- MARKETS: Sensex Down 300 Pts, At Days Lo...

- Afghanistan Crisis Live Updates: NIA Chi...

- Women Will Be Admitted To NDA, "Historic...

- Taliban's New Education Minister Says Ph...

- India's T20 World Cup Selection Question...

- New JioFiber Quarterly Broadband Plans I...

- Explained: How Your Cat Got Its Stripes...

- Who Is Aesha Mukherji? All You Need To K...

- Long Live Test Cricket While We've Virat...