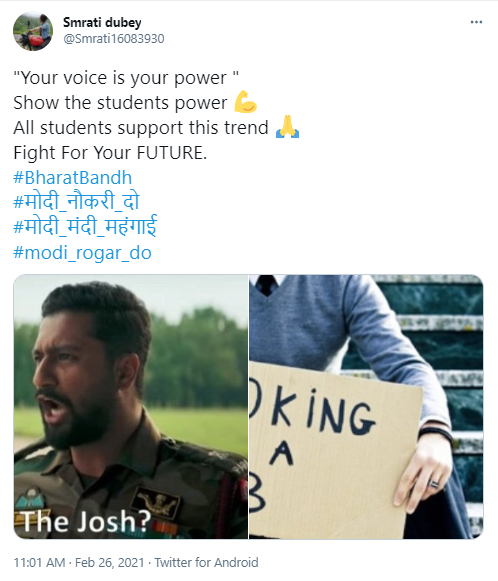

All India Traders Precognize #Bharatbandh

The Confederation of All India Traders have announced Bharat Bandh on 26th February regarding fuel price hike, the new E-way bill and the Goods and Services Tax.

The protest will be joined by different unions including the Bharatiya Kisan Union Morcha and the All India Transport Welfare Association.

According to reports, major markets, trucks and transports will remain closed but essential services won’t be affected.

The CAIT and the AITWA are seeking to scrap the newly amended E-way bill demanding to withdraw certain rules from the bill.

Around 40,000 trade associations will be joining the CAIT protests and will be raising their voices against the fuel price hike and the extradited GST.

AITWA President Mahendra Arya said “All state level-transport associations have confirmed their support to AITWA in this one-day non-operation of transport in protest of the fuel price hike and scrapping of new E-way bill laws introduced by Government of India. The nature of the movement is to reject booking and movement of all E-Way Bill oriented goods for one day. All transport companies are asked to park their vehicles between 6 am to 8 pm as a symbolic protest. All transport godowns will display the protest banners. All customers will be approached by transport companies not to book or load any goods on February 26, 2021.”

Expressing dissent over the GST regime, the associations such as CAIT and AITWA demand simplifying several tax slabs. The CAIT criticizing the GST said “We highly regret such a dismal attitude and picture of the GST which has compelled the trade union leaders attending the conference to call for a Bharat Trade Bandh.”

Bombay Goods and Traders organisation have extended its support to the CAIT clarifying participation of more than 10 lakh tractors in today’s #Bharat Bandh.

Penalties for a truck carrying a consignment with an expired E-way bill, or with an erroneous E-way bill amount to 200 percent of the tax value, or 100 percent of the invoice value under Section 129 of CGST Act, 2017.For small and medium transporters, especially those involved in part-load movement of goods or retail transportation, complying with the new rule has meant a higher and costly compliance burden, with penalties running into lakhs of rupees.

Along with the E-way bill, the protestors further claim to raise their voices against the fuel price hike. The bandh is seeking enormous support from the farm unions especially the Bharatiya Kisan Morcha as they say “Farmers stand in favour of the traders union and transporters who have called for the Bharat Bandh today against upsurging fuel price hikes and the GST.”

Yesterday, West Bengal CM Mamata Banerjee was seen protesting in a unique way when she rode pillion waving the needs to hinder fuel price hike.

The Bharat bandh has already gathered enough attention on social media platforms. Not only the large unions but the small traders, suppliers, farmers and women entrepreneurs have extended support to the cause.

For more trends, follow Checkbrand!

CATEGORIES

- Digital Marketing

- Marketing

- Entertainment

- Medical

- Science and Technology

- Politics

- Sports

- Environment

- Campaign

- Interview

- Viral

- What's Trending

- Trending News

- Viral Videos

- Youtube Trends

- Social Media Ranking

- Twitter Trends

- Google Trends

- Top Politicians

- Top Cricketers

- Top Influencers

- Best Campaigns

- Google News

- News

-

Oct 11, 2020

Oct 11, 2020SEO Content Writing Vs. SEO Copywriting:...

-

Dec 15, 2020

Dec 15, 2020#Karnatakaiphoneplantagitation: Workers...

-

Dec 15, 2020

Dec 15, 2020#OLA Invests ₹2400 Crores For Our Futur...

-

Dec 15, 2020

Dec 15, 2020#Snapchat Launches Astrology Profile

-

Dec 15, 2020

Dec 15, 2020Know Why #BOYCOTTJIOSIM Is Trending On S...

-

Aug 01, 2023

Aug 01, 2023India's Chandrayaan-3 On Track For Lunar...

-

May 17, 2023

May 17, 2023Zara Hatke Zara Bachke Trailer Review(Ra...

-

Aug 04, 2022

Aug 04, 2022'Har Ghar Tiranga' Campaign Created Stor...

-

Dec 16, 2020

Dec 16, 2020#Skillhaitohfuturehai: Mahindra's Flagsh...

-

Dec 15, 2020

Dec 15, 2020#OLA Invests ₹2400 Crores For Our Futur...

HIGHLIGHTS

- Realme Pad Specifications Teased, Will C...

- MARKETS: Sensex Down 300 Pts, At Days Lo...

- Afghanistan Crisis Live Updates: NIA Chi...

- Women Will Be Admitted To NDA, "Historic...

- Taliban's New Education Minister Says Ph...

- India's T20 World Cup Selection Question...

- New JioFiber Quarterly Broadband Plans I...

- Explained: How Your Cat Got Its Stripes...

- Who Is Aesha Mukherji? All You Need To K...

- Long Live Test Cricket While We've Virat...